Consider Gold as an Investment for your Future

Jar is a savings app that enables you to save your money in 24K gold daily, weekly or monthly. Saving in gold daily can enable you to not only build your daily savings habit but also invest in Gold and enjoy the appreciation in the principal value of your savings.

Start Investing in Gold Daily

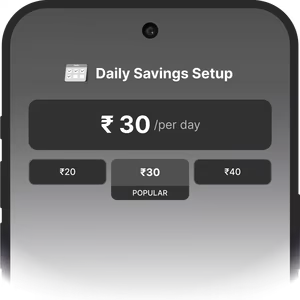

Start investing your savings in gold daily with Jar. With Jar, you can easily setup an auto-pay for daily, weekly or monthly and invest every day in gold. Daily savings have never been easier. Build a savings habit with gold investing.

Digital Gold Investment Made Easy

Gold investing traditionally was only for large investors due to the high value and large minimum quantities. Jar is changing this by allowing regular people to buy gold in small quantities starting from 10 Rs, making digital gold investing accessible to all Indians.

India’s Best Gold Investing App

More than 2Cr Indians have trusted Jar with their savings and have invested in Gold with Jar. Anyone with a PAN card can now invest in digital gold online easily. Jar is recognised by every Indian, making it the best gold investing app in India.

Learn How to Invest in Gold Bullion with Jar

Investing in gold has never been easier with Jar. Gold is no longer a complex investment asset but a savings tool for all Indians. Jar is breaking the barriers in investing in gold and making gold investments easy.

You can start investing in digital gold in minutes just by setting up your account KYC, attaching your PAN and setting an auto-pay for as low as Rs. 10 per day.

Choose Your Gold Investment Plan

Maximize your Returns with our Gold Investment Plan

Start investing in gold daily, weekly or monthly and buy gold for as low as 10 Rs. Check gold price on the app here to find the latest gold rates in India.

Plan your Next Move with our Gold Investment Calculator

Plan your investments with Jar’s gold investment calculator. Enter the daily amount you want to save, how long you want to save and get a prediction on how much your gold funds will appreciate in value. You also have an option to choose digital gold as an investment.

Create a Systematic Investment Plan in Gold SIP

Jar enables you to start a gold Systematic Investment Plan online easily in just 3 steps. A Gold SIP Calculator is a tool that helps you plan and estimate your investments in gold over a period of time. Just like a regular SIP for mutual funds, a Gold SIP allows you to invest a fixed amount regularly in digital gold.

The calculator helps you understand how much gold you can accumulate by investing a certain amount regularly, taking into account the current gold prices and the duration of your investment.

The Safest Way to Buy Gold

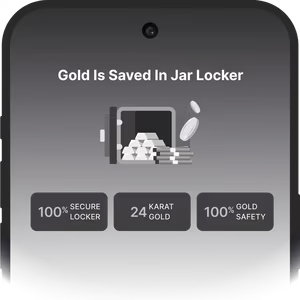

Jar provides the safest way of buying gold online with just your phone. The traditional channels to buy gold do not provide flexibility to the buyer. The traditional gold sellers either have purity issues or minimum investment value. Jar only has 99.95% pure gold on its platform and has a minimum investment value of 10 Rs. You can easily buy gold in 3 steps in minutes with the maximum safety. 2cr Indians have trusted us with their savings and investments in digital gold. Start your best gold investment journey today with Jar.

Jar Gold: Perfect for Investing in Gold for Beginners

Find the Best Gold Coins to buy at Nek

Nek, Jar’s online gold and silver shopping platform offers the best deals on gold coins, gold bars, and jewelry. Find the best coin investments that fit your savings. Investing in Gold & Silver made easy.

Frequently Asked Questions

How to invest in gold?

You can buy 24k digital gold by creating an account in Jar App in just 45 seconds. You can also get your Gold Delivered to your doorstep if you buy Gold Coins or Bars from Jar’s App.

You can Buy Gold anytime you want with the simple steps below.

– Tap on the “Hamburger” menu at the top-left side of the screen.

– Then, tap on “Save Manually”

– Now, you’ll be able to see the “Live Buy Price.” Enter the amount in Rupees/Grams.

– Now, tap on “Buy Now”.

What is the best way to invest in gold?

There are multiple ways to invest in gold—digital gold, gold ETFs, gold F&O, gold mutual funds, sovereign gold bonds (SGBs), gold mining stocks, purchasing physical gold, and more.

Investors can start investing in digital gold with ₹10 through the Jar App. Digital gold offers flexibility, free storage, and guaranteed purity.

What is a gold investment?

Gold investment is a method of purchasing gold as a means of security in times of financial adversity.

Investors can invest in gold by purchasing gold bars, gold coins, and gold jewellery, or by investing in financial instruments such as gold ETFs, digital gold, gold mutual funds, sovereign gold bonds, etc.

Gold acts as a hedge against inflation and is a great asset for diversifying investment portfolios.

How to buy digital gold?

Digital gold is the online equivalent of physical gold, where your investment is backed by real, 24K gold stored securely in vaults, without the need for physical possession.

To buy digital gold, follow these steps:

1) Choose a Trusted Platform: Use reliable platforms like Jar.

2) Sign Up: Register with your details and complete verification.

3) Check Live Prices: Platforms show real-time gold prices.

4) Select Amount: Buy digital gold in small amounts, starting from ₹10 worth.

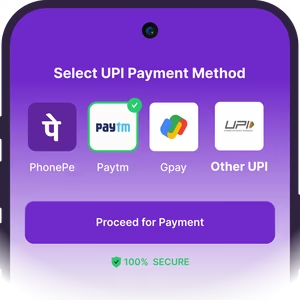

5) Make Payment: Pay via UPI, debit/credit card, or your preferred payment method.

6) Track Investment: Watch your gold grow in value in one dashboard on your trusted platform like Jar.

7) Redemption Options: You can sell or convert it into physical gold later.

Digital gold allows low-cost investment with no storage hassle and offers liquidity and transparency.

How to invest in gold online?

Gold is onYou can buy gold online in two forms: physical gold and digital gold. To purchase physical gold, visit the trusted online stores of reputable jewelers where you can buy gold coins, bars, and jewelry. Physical gold typically requires a larger investment.

For smaller amounts, digital gold is a more accessible option. Here’s how to buy digital gold:

1. Choose a Trusted Platform: Use reliable platforms like Jar.

2. Sign Up: Register and complete the KYC process.

3.Select Amount: Buy digital gold in small amounts, starting from ₹10.

4. Make Payment: Pay through UPI, debit/credit card, or your preferred payment method.

For more details on how to start, check out the Jar guide to buying digital gold.

What is digital gold?

Digital Gold is a modern way of investing in gold without physically owning it. It allows you to buy small amounts of pure, 24K gold online, which is backed by real gold stored in insured vaults.

When you buy digital gold, your investment is tracked and secured by trusted platforms, and you can later choose to sell it back or convert it into physical gold (like coins or jewelry). It’s an accessible and flexible way to invest in gold, starting with small amounts, without the concerns of storage or security typically associated with physical gold.

Key Features of Digital Gold:

Digital Gold is a modern way of investing in gold without physically owning it. It allows you to buy small amounts of pure, 24K gold online, which is backed by real gold stored in insured vaults.

Should I invest in gold?

While gold is a volatile commodity, it has incurred excellent long-term returns for investors. During geopolitical disorder and the global financial crisis, gold has served as a safe haven for investors.

How to buy paper gold?

Paper gold refers to financial instruments such as gold exchange-traded funds (ETFs), sovereign gold bonds (SGBs), futures contracts, etc.

Investors can purchase paper gold through institutions like BSE and NSE or other government institutions offering SGBs.

How to invest money in gold?

Investors can invest their money in gold through purchasing physical gold, gold bars, gold coins, gold ETFs, gold mutual funds, gold F&O, or digital gold.

Digital gold refers to real gold that is bought and sold digitally. It reduced the risk of theft, storage fee charges, and paperwork.

Where to invest in gold?

Investors can invest in gold through gold ETFs, gold mutual funds, sovereign gold bonds, etc. The best and easiest way to invest in gold is through the Jar App, which offers an easy registration process and quick disbursement.

How to purchase gold online?

One can purchase gold online through certified sellers or online platforms offering the precious metal. The Jar App allows users to buy pure 24kt gold coins along with an option to invest in digital gold without any storage fee.

Which monthly gold scheme is best for investment?

There are many well-known sellers and financial institutions that offer monthly gold scheme investments. It is advisable to do market research before choosing a gold scheme according to your investment plans.

How to buy digital gold in India?

Many fintech platforms and financial institutions offer digital gold on their platforms. Users can buy digital gold from ₹10 via the Jar App in just a few simple clicks.