Who doesn't have the dream of owning a house! It's an indication of social status and means of investment. It often takes a lifetime's worth of saving to make that dream come true. That's why, home loans are there to fast-forward the process. But home loans with a low credit score can seem like a far-fetched dream.

A credit score is a three-digit number that indicates your risk status as a borrower and your creditworthiness.

It ranges from 300-900. But for a home loan applicant, you need a credit score of 750 and above to get approved as it is a large investment.

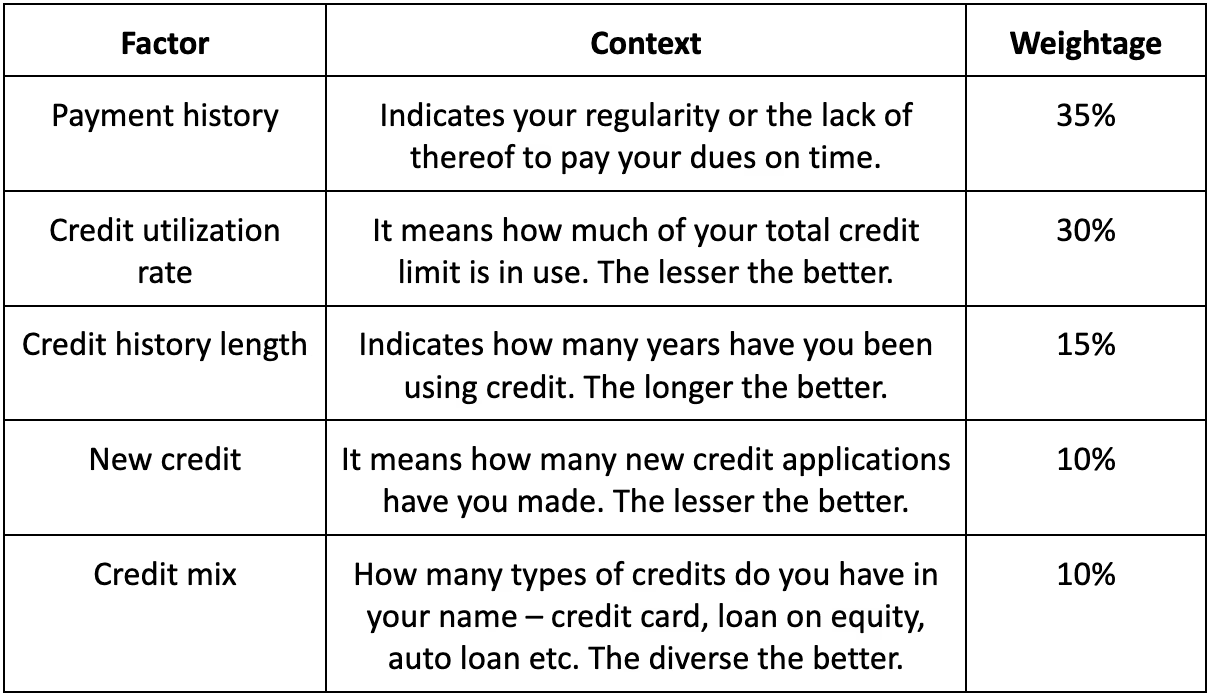

To better understand how credit score impacts your home loan application, you must first know how it is calculated.

How Does Credit Score Work?

To calculate your credit score, credit authorities consider the below factors:

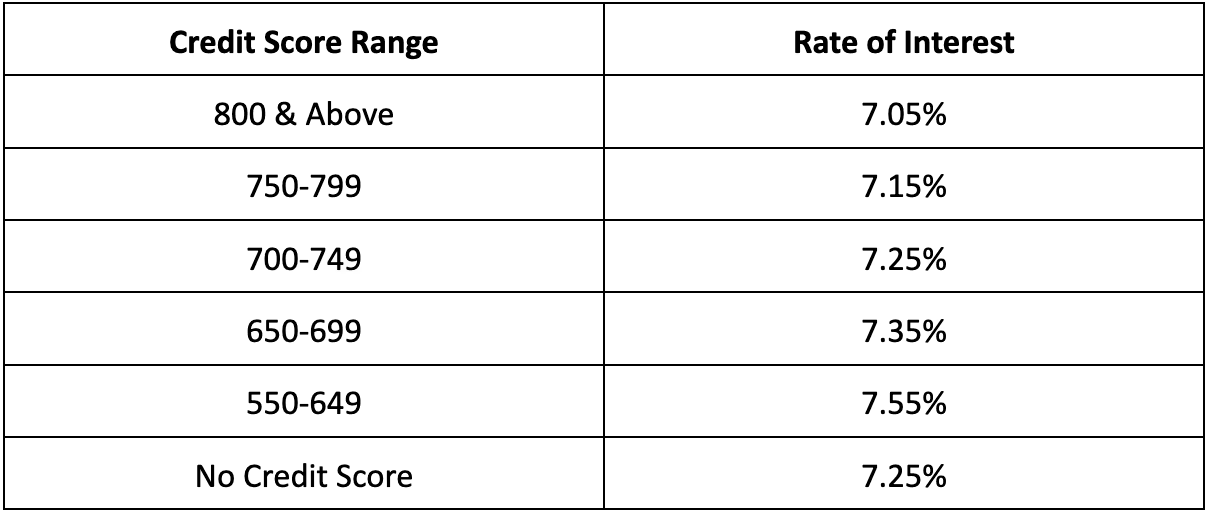

Home Loan Interest Rate Based on Credit Score

Applicants with a healthy credit score and regular payment track record get the lowest interest rate and the longest tenure.

But if your credit score is below 750, you may face many challenges. These include higher interest rates, short tenure, and even application rejection.

However, when there is a will, there is a way. There are many housing finance companies and banks that offer curated home loans for poor credit score holders.

Although it varies from organization to organization, it could look somewhat like this:

How To Get A Home Loan With A Low Credit Score

Getting a home loan with bad credit score can be challenging but not impossible. Here’s how you can get it:

1. Get A Lower Fixed Obligations to Income Ratio (FOIR)

FOIR essentially is the ratio of the total amount of fixed obligations (debt) you have per month against your monthly income.

It includes the EMI payment of the home loan you are applying for. Banks determine this ratio and can restrict the loan amount you can get.

So, if the bank or housing finance companies refuse to give you a large amount as a home loan, then you can ask them to reduce the FOIR.

But that also means a lower loan amount.

2. Opt for a lesser LTV

Loan to Value (LTV) is a ratio that captures the loan amount vs the total property value. According to the RBI guidelines, banks can lend up to 85% LTV.

However, it varies from bank to bank. And housing finance companies follow their own benchmarks.

So, if your credit score is poor, you can ask the loan provider to reduce the LTV and increase your downpayment amount.

3. Take Help From A Co-Signer

Getting a third person to become your co-signer is another way to get a home loan with a poor credit score.

This co-signer should have a stable financial standing and a good credit score.

If you miss a loan payment for 90+ days, the loan provider can choose to get the owed amount from the co-signer.

Therefore, being a co-signer is a major responsibility. So, only someone very close to you should be your co-signer.

4. Offer Additional Security

Normally, a home loan is disbursed based on the value of the property you want to buy. It acts as primary security.

So, if you are unable to pay back your loan, the loan provider can foreclose your home to recover the loan amount.

If your credit score is low, one way you can get a home loan is by offering additional security.

It could be fixed deposits, gold, or car, anything. This will ensure you get a higher loan amount.

5. Compromise With Rate Or Tenure

A loan applicant with an unblemished credit score gets the lowest interest rate or the longest loan tenure.

But if you have a bad credit history, it can mess up your home-owning plans exponentially.

It is because the bank cannot grant you a loan with a low credit score.

So, what you can do is negotiate to grant you the home loan in exchange for a higher interest rate or a shorter tenure.

How To Get A Home Loan?

Once you have covered all your bases, there are three ways you can apply for the loan:

- Apply online: Search for home finance companies or banks that offer home loans to people with bad credit ratings. You can apply from their website. Read all the terms and conditions before leaving your details on the application form. The loan agents will contact you.

- Contact a mortgage broker: If you are hitting dead ends after dead ends in your pursuit to get a home loan, it is time for you to contact a mortgage broker. These are third parties who can connect you with the right provider based on your situation for a fee.

- Reach out to your existing bank: If you already have a bank account for a long time, you can apply there. Since the bank already has all your records, they would be more inclined to offer you the loan. So, there are high chances for you to get a pre-approved loan (with a soft credit inquiry).

- Get financing from the real estate company: Today, most real-estate companies have tie-ups with banks and home financing companies. So, in order to increase their sale, they are more likely to offer you a loan. But make sure you read and understand all the fine print before signing.

How A Home Loan Impacts Your Credit Score?

Credit scores can drop for many reasons. That should not stop you from fulfilling your dream of owning a house.

If you have a stable income and develop a responsible financial habits, you can improve your credit score by paying all your dues on time.

Then, it would be easier for you to refinance and gradually reduce your monthly payment amount.

But, it is true that the state of your credit score does have an immense impact on your home loan application.